Tec-Verse 2025: India’s Leap into Deep-Tech Innovation for a Self-Reliant Future-ready

- Dr.Sanjaykumar Pawar

Table of Contents

- Introduction

- The Vision Behind Tec-Verse

- MeitY’s Role in Deep-Tech Ecosystem

- Day 1 Highlights: Product Launches, MoUs & ToT

- Breakthrough Technologies Showcased

- Key Stakeholders & Collaborators

- Deep-Tech for Real-World Impact: Sector-Wise Analysis

- From Service Economy to Product Nation

- Aligning with Viksit Bharat 2047 & Azadi Ka Amrit Mahotsav

- Expert Opinions & Policy Implications

- Visual Recap of Tec-Verse 2025

- Conclusion

- FAQs

1. Introduction

India is stepping confidently into the future of technology—and Tec-Verse 2025 is living proof. Organized by the Ministry of Electronics & Information Technology (MeitY) on June 27–28, 2025, this landmark event brought together brilliant minds, cutting-edge innovation, and a vision for self-reliance under one roof. But Tec-Verse isn't just another tech exhibition. With over 150+ indigenous innovations unveiled by premier R&D organizations like C-DAC, C-MET, and SAMEER, it represents India’s evolving identity—from a global IT services hub to a deep-tech product nation.

At the heart of Tec-Verse lies a powerful message: India is building for the world, in India. These innovations span from AI-powered solutions and quantum computing to advanced microelectronics and medical technologies, reflecting the country’s shift towards future-ready tech leadership.

Tec-Verse 2025 is deeply intertwined with two visionary national goals:

- Azadi Ka Amrit Mahotsav, commemorating 75+ years of freedom through technology-driven pride.

- Viksit Bharat @2047, a roadmap for India to emerge as a fully developed nation by its centenary year of independence.

In many ways, this event isn't just about tech—it's about India's bold declaration: We’re ready for tomorrow.

2. The Vision Behind Tec-Verse

At the heart of Tec-Verse 2025 lies a bold mission: to turn India’s tech dreams into tangible realities. As S. Krishnan, Secretary, MeitY, aptly put it, “Tec-Verse marks a decisive step in transforming publicly funded research into market-ready products, aligning with India’s ambition to become a true product nation.”

This vision isn't just aspirational—it’s deeply strategic. Tec-Verse is about democratizing innovation, breaking the silos of elite research labs and opening them up to the public, entrepreneurs, industry leaders, and policymakers. By doing so, it invites real-world collaboration and feedback early in the R&D cycle.

The event also tackles a long-standing challenge in Indian innovation: the lab-to-market gap. By fostering dialogue between researchers and industry stakeholders, Tec-Verse accelerates the journey from prototypes to products.

Most importantly, Tec-Verse reinforces the spirit of ‘Atmanirbhar Bharat’. In an era dominated by global supply chains, India is boldly investing in indigenous technologies—from semiconductors to health tech—to reduce reliance on foreign imports.

In essence, Tec-Verse is more than an exhibition. It’s a powerful national statement: India is not just innovating for itself—it’s innovating for the world.

3. MeitY’s Role in Deep-Tech Ecosystem

Behind the scenes of India’s technological leap lies a powerhouse—MeitY. Through its R&D arms—C-DAC, C-MET, and SAMEER—the ministry has quietly but powerfully built the foundation for India's deep-tech ecosystem. These institutions aren’t just research hubs—they’re engines of innovation driving India’s self-reliance and global competitiveness.

From High Performance Computing (HPC) and cybersecurity to the cutting edge of quantum tech, AI/ML, 6G telecom, power electronics, and IoT-enabled UAVs, MeitY’s institutions are advancing technologies that matter—not just for today, but for the future.

At Tec-Verse 2025, these three organizations came together under one roof, creating a unique platform that reflects a cohesive innovation ecosystem. This synergy wasn’t just symbolic—it was practical. Attendees witnessed real, working prototypes and scalable tech solutions, proving that collaborative R&D can deliver high-impact outcomes.

Whether it’s building India’s own quantum processors or developing indigenous AI models, MeitY is no longer working in isolation—it’s orchestrating a national movement. The result? A thriving ecosystem where research meets reality, and innovation leads to independence.

4. Day 1 Highlights: Product Launches, MoUs & Technology Transfers

Day 1 of Tec-Verse 2025 kicked off with energy, ambition, and a strong sense of purpose. The atmosphere buzzed with excitement as India’s premier tech institutions moved from idea to impact in front of a national and global audience. The results were nothing short of inspiring.

The Numbers That Matter:

- 4 cutting-edge products launched

- 8 high-impact Technology Transfers (ToTs)

- 15 strategic Memorandums of Understanding (MoUs) signed

These weren’t ceremonial announcements—they were real, transformative steps forward. Each product launch reflected India’s growing ability to build deep-tech solutions domestically, while the technology transfers signaled a direct pipeline from labs to industry.

Collaborations That Matter:

Some of India’s biggest tech players joined hands with MeitY’s R&D arms:

- Bharat Electronics Ltd. (BEL)

- Tata Consultancy Services (TCS)

- L&T Limited

- SCL-Mohali

- Voltix Semicon Pvt. Ltd.

These partnerships are laser-focused on national priorities such as:

- Industry 4.0 solutions that modernize manufacturing through automation and data.

- India Sovereign Cloud, ensuring secure, indigenous cloud infrastructure.

- Advanced Semiconductor Packaging, a crucial step for chip self-reliance.

- Next-Generation Communication Systems, paving the way for 6G and secure telecom.

Why It Matters:

Often, public R&D remains confined within institutions, failing to see the light of day. But Tec-Verse proved otherwise. These technology transfers and MoUs serve a larger purpose: ensuring that innovations are not only developed in India but also deployed at scale. That means solutions are going beyond research papers—they’re getting into the hands of industries, defense, healthcare, and the everyday citizen.

With products and platforms co-developed by MeitY organizations and private sector giants, the message is clear: India is ready to co-create the future.

Tec-Verse’s Day 1 wasn’t just a showcase—it was a launchpad for collaborative growth. It demonstrated how government, academia, and industry can work hand-in-hand to transform R&D into real-world value, boosting India’s tech leadership on the global stage.

In short, Day 1 turned innovation into action—and action into impact.

5. Breakthrough Technologies Showcased

The 150+ innovations presented can be grouped into key transformative domains:

| Technology Domain | Application Areas | Lead Organization |

|---|---|---|

| Quantum Computing | Cryptography, Drug Discovery | C-DAC |

| IoT & AI | Smart Agriculture, Predictive Healthcare | C-DAC |

| Semiconductor Tech | Advanced Packaging, Power Electronics | C-MET |

| EMI/EMC Engineering | Industrial Electronics, Automotives | SAMEER |

| Health Tech | Portable Diagnostics, Remote Monitoring | SAMEERp |

| 6G & Communication | Next-gen Connectivity, Secure Networks | C-DAC, SAMEER |

| UAV & Robotics | Disaster Management, Surveillance | C-DAC |

Each solution presented aims to tackle pressing societal issues such as rural healthcare gaps, climate-resilient farming, energy optimization, and secure digital infrastructure.

6. Key Stakeholders & Collaborators

Tec-Verse 2025 wasn’t just a showcase of cutting-edge technology—it was a coming together of minds, institutions, and sectors that define India’s innovation landscape. With over 1,000+ participants spanning government, academia, industry, and startups, the event reflected a truly holistic, whole-of-society approach to building the nation's tech future.

Leadership at the Helm

The presence of senior policymakers underscored the strategic weight of the event. Among the top dignitaries were:

- S. Krishnan, Secretary, MeitY – whose vision of turning R&D into market-ready products set the tone for the entire event.

- Amitesh Kumar Sinha, Additional Secretary, MeitY – a key driver in fostering public-private partnerships.

- Caralyn Khongwar Deshmukh, Additional Secretary (Social Justice) – reinforcing the role of inclusive tech in equitable development.

- Prof. Rajeev Ahuja, Director, IIT Ropar – representing academia’s crucial role in research and talent building.

Their insights and active participation weren’t just ceremonial—they formed the backbone of deep discussions on national tech priorities, regulatory support, and pathways for commercialization.

Academia, Industry & the Startup Ecosystem

Equally significant was the participation of academic leaders, industry stalwarts, and startup founders. From IITs and research institutes to major tech companies and agile startups, the diversity of contributors highlighted a collaborative ecosystem in action. This mix ensured that ideas could be refined, tested, and scaled across domains—from semiconductors and AI to sustainable electronics and next-gen telecom.

Startups, in particular, stood out as agile adopters and co-developers of MeitY’s innovations. Many expressed interest in licensing tech or integrating government-backed solutions into their platforms, bridging the crucial lab-to-market gap.

Youth & Innovation Champions

A special spotlight was also placed on young innovators and student entrepreneurs. Their prototypes, many backed by MeitY’s funding schemes, showed immense promise—from affordable health tech to smart agri-solutions. Their presence reinforced a critical truth: India’s tech future belongs not just to institutions, but to its youth.

The Message: Unity in Innovation

Tec-Verse 2025 made it clear that building a Viksit Bharat by 2047 won’t be a solo journey. It requires a convergence of visionaries, doers, and enablers. And at Tec-Verse, that convergence became a reality.

7. Deep-Tech for Real-World Impact: Sector-Wise Analysis

At Tec-Verse 2025, technology wasn’t just showcased—it was connected to real problems and everyday lives. The innovations on display weren’t futuristic fantasies. They were practical, purpose-driven solutions tailored to the challenges India faces today—especially in healthcare, agriculture, telecom, and industry.

Healthcare: Tech That Heals

Imagine a small health center in rural India being able to perform accurate diagnostics without specialist doctors or expensive machines. That’s now possible, thanks to:

- AI-powered portable diagnostic kits

- Real-time remote patient monitoring systems

- Indigenous imaging solutions

These tools, developed by MeitY’s R&D arms, are not just advanced—they’re affordable and accessible, giving a new lease of life to healthcare in tier-2 and rural areas. It’s a leap towards healthcare equity, making quality care reachable for all.

Agriculture: Farming Gets Smarter

India’s farmers often rely on intuition—but Tec-Verse is changing that with:

- AI-driven precision farming systems

- IoT-based climate and soil sensors

These technologies provide real-time insights into crop health, moisture levels, and weather patterns, enabling farmers to make data-informed decisions. The result? Better yields, reduced water usage, and more sustainable farming.

Telecom & Connectivity: Building for the Future

In the digital age, connectivity is everything. And at Tec-Verse, India unveiled its very own:

- 6G architectural frameworks

- Secure communication platforms

These developments not only ensure data sovereignty, but also lay the foundation for a next-gen, indigenous telecom infrastructure that’s robust, resilient, and future-ready.

Industry 4.0: Smarter Manufacturing

To compete globally, Indian manufacturing must become smarter and leaner. Enter:

- Smart sensors enabling factory automation

- Predictive maintenance tools that reduce downtime

These innovations directly fuel the Make-in-India movement, boosting productivity and reducing operational costs across sectors like electronics, automotive, and aerospace.

The technologies at Tec-Verse aren’t isolated breakthroughs—they are interconnected building blocks of a smarter, more self-reliant India. Whether it’s healing the sick, feeding the nation, connecting citizens, or powering industry, MeitY’s deep-tech innovations are driving real-world impact where it’s needed most.

Tec-Verse 2025 made one thing crystal clear: When deep-tech meets real problems, the results can transform a nation.

8. From Service Economy to Product Nation

For decades, India has been celebrated as the world’s back office—a global IT powerhouse known for its talent and service delivery. With an IT industry valued at over $245 billion, this service-centric model has been a cornerstone of economic growth. But Tec-Verse 2025 marks a clear and bold inflection point: India is moving from exporting talent to exporting technology.

The vision is no longer about providing support for global tech giants—it's about becoming one. This means developing intellectual property (IP), creating indigenous products, and building homegrown digital platforms that solve real problems—not just for India, but for the world.

As S. Krishnan, Secretary, MeitY, puts it:

"We are building compute infrastructure, foundation models, and applications to address real-world societal needs."

This is a game-changing vision. India is now investing in building core technology stacks—including AI foundation models, sovereign cloud architecture, quantum computing capabilities, and semiconductors. This not only strengthens national security and economic independence but also lays the groundwork for tech sovereignty in an increasingly digital global order.

What makes this shift so important is its alignment with India’s larger economic vision—the goal of becoming a $5 trillion economy. To get there, innovation cannot remain fragmented or outsourced. It must be owned, nurtured, and scaled within the country. Tec-Verse demonstrated that this transition is already underway.

From startups showcasing world-class products to research labs transferring IP to industry giants, the event was a clear indicator that India is ready to lead with products, not just people. This move from services to products isn’t just economic—it’s cultural. It signals a new mindset: one that values creation over execution, and ownership over outsourcing.

Tec-Verse 2025 showed us what this future looks like. It’s a future where Indian engineers don’t just write code—they build the platforms. Where startups don’t just pitch abroad—they scale at home. And where India doesn’t just follow global trends—it sets them.

From service economy to product nation—India is ready for this leap, and Tec-Verse was its bold announcement to the world.

9. Aligning with Viksit Bharat 2047 & Azadi Ka Amrit Mahotsav

Tec-Verse 2025 isn’t just a celebration of innovation—it’s a tribute to India’s journey of resilience, growth, and self-determination. It stands at the powerful intersection of two defining national visions: Azadi Ka Amrit Mahotsav and Viksit Bharat 2047.

Azadi Ka Amrit Mahotsav: Honoring Freedom with Innovation

As India celebrates 75+ years of independence, Azadi Ka Amrit Mahotsav is more than just a symbolic campaign—it’s a reflection on how far we’ve come and where we’re headed. Tec-Verse fits perfectly into this narrative. It represents a freedom of a different kind—freedom from technological import-dependency.

For years, India has relied on foreign technologies, especially in critical sectors like electronics, semiconductors, and telecom. But now, through initiatives like Tec-Verse, the country is asserting its right to build at home, using homegrown talent, research, and resources. It’s a form of tech independence that echoes the spirit of political independence—India, self-reliant and self-assured.

Viksit Bharat 2047: The Roadmap to a Developed Nation

Looking forward, the Viksit Bharat 2047 vision sets the ambition for India to become a fully developed nation by its 100th year of independence. But this dream isn’t just about GDP numbers—it’s about creating an ecosystem where technology empowers every citizen.

Tec-Verse serves as the technological backbone of that vision. It showcases real innovations—affordable healthcare tools, AI for agriculture, secure telecom infrastructure, and advanced manufacturing solutions—that directly support national development goals.

By bringing together scientists, startups, policymakers, and industry leaders, Tec-Verse helps align research with real-world needs. This ensures that innovation isn’t happening in isolation—it’s strategically connected to India's socio-economic transformation.

A Timely and Transformative Initiative

The dual alignment with Azadi Ka Amrit Mahotsav and Viksit Bharat 2047 makes Tec-Verse more than a tech event—it becomes a national mission. It reflects the confidence of a country no longer content with playing catch-up, but ready to lead.

10. Expert Opinions & Policy Implications

Beyond the gadgets, demos, and buzz, Tec-Verse 2025 sent a powerful message: India’s deep-tech future depends on collaboration and smart policymaking. And that message resonated strongly with leading voices in the innovation ecosystem.

Bridging the Gaps: Expert Views

Dr. Radhika Pandey, Senior Fellow at NIPFP, highlighted a crucial point:

“Events like Tec-Verse bridge the demand-supply mismatch in deep-tech by fostering public-private-academia synergies.”

In a sector where industry often lags behind global R&D trends and academia operates in silos, Tec-Verse acts as the meeting ground. It breaks traditional boundaries and brings together researchers, entrepreneurs, startups, and policymakers—all focused on solving real-world problems with Indian-built tech.

Prof. Rajeev Ahuja, Director of IIT Ropar, echoed this thought:

“The future lies in collaborative research where industry drives innovation. MeitY is catalyzing that change.”

For years, Indian academia has produced solid research, but translating that into market-ready products has remained a challenge. MeitY, through initiatives like Tec-Verse, is pushing for a culture of co-creation—where institutions don’t just publish papers but also build platforms and businesses.

Policy Implication: Time to Invest Smarter and More

Despite the energy in India’s innovation space, a hard truth remains: our R&D investment is still less than 0.7% of GDP, as per the UNESCO Institute for Statistics. Compared to developed nations that invest 2–4%, this figure reveals a gap not just in funding, but in prioritization.

However, Tec-Verse 2025 demonstrates how every rupee invested in R&D can yield significant economic and social returns. From enabling rural healthcare to boosting smart manufacturing, the showcased technologies proved that innovation isn’t a cost—it’s an economic multiplier.

The policy takeaway is clear: India must scale up R&D investments, incentivize private-sector research, and nurture deep-tech startups with regulatory clarity and capital support.

Looking Ahead

Expert voices agree—events like Tec-Verse are more than showpieces. They are policy nudges, prompting governments to back science and technology not just with vision, but with budget and intent.

Tec-Verse 2025 didn’t just spotlight innovations—it spotlighted what’s possible when India bets big on itself.

11. Visual Recap of Tec-Verse 2025

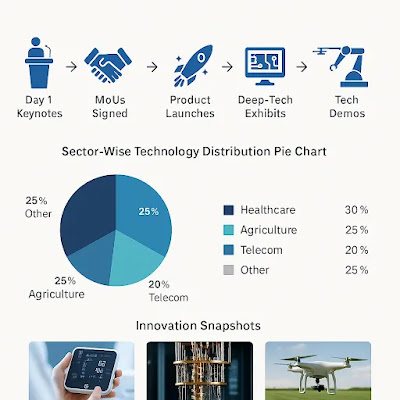

[ infographic timeline: Day 1 Keynotes → MoUs Signed → Product Launches → Deep-Tech Exhibits → Tech Demos]

[ graph: Sector-Wise Technology Distribution Pie Chart]

[carousel: Innovation Snapshots – Healthcare Device, Quantum Simulator, Smart Farming Drone]

12. Conclusion

Tec-Verse 2025: A Movement, Not Just a Milestone

Tec-Verse 2025 isn’t just a moment in India’s tech journey—it’s a movement that signals a deeper shift in mindset and ambition. It represents India's collective effort to reclaim its innovation narrative, where ideas born in Indian labs are nurtured, scaled, and celebrated on the global stage.

This movement is about bridging the long-standing gap between academia and industry, ensuring that research doesn’t end in journals but begins to solve real problems—be it in health, farming, defense, or communication. It’s about recognizing that India’s challenges—rural healthcare, climate-resilient agriculture, secure digital infrastructure—require homegrown, context-driven solutions.

And most importantly, Tec-Verse is about building global solutions from Indian soil. With technologies now emerging from institutions like C-DAC, C-MET, and SAMEER, India is sending a strong message: we’re not just participants in the global tech arena—we're shaping it.

With vibrant participation from startups, students, corporates, and policymakers, Tec-Verse lays the foundation for India’s transformation into a true technological powerhouse by 2047. It’s not just a showcase of innovation—it’s a declaration of intent.

India is not waiting for the future. At Tec-Verse, it’s building it.

13. Frequently Asked Questions (FAQs)

Q1: What is Tec-Verse 2025?

A: It’s a tech showcase by MeitY’s R&D organizations to present over 150 indigenous innovations across healthcare, telecom, AI, agriculture, and more.

Q2: Which organizations are involved?

A: C-DAC, C-MET, and SAMEER—MeitY’s premier R&D bodies.

Q3: What was launched at Tec-Verse 2025?

A: 4 product launches, 8 technology transfers, and 15 MoUs with top Indian firms.

Q4: How does this align with Azadi Ka Amrit Mahotsav?

A: Tec-Verse promotes tech independence, celebrating 75+ years of freedom through self-reliance.

Q5: Will Tec-Verse be organized again?

A: Yes, it’s planned as an annual event to foster continuous innovation.

🔍 Sources & References

- Press Information Bureau, Govt. of India – PIB.gov.in

- MeitY Official Website

- [UNESCO Science Report (2021)]

- [CDAC, SAMEER, C-MET R&D Portals]

- Economic Survey of India 2024-25

- IITs and NIPFP research publications

.PNG)