📌 Table of Contents

- Introduction

- What are Remittances and Why Do They Matter?

- FY25: A Record-Breaking Year for India

- India’s Global Standing in Remittance Inflows

- Where Are These Remittances Coming From?

- Who Sends the Money: The Indian Diaspora

- How Do Remittances Impact India’s Economy?

- Gulf Countries and the Indian Workforce

- Policy Environment: U.S. Tax Relief & Other Developments

- Challenges in Remittance Ecosystem

- Expert Opinions & Global Trends

- Infographics & Visuals

- Conclusion: Remittance Power in India's Growth Story

- FAQs

1. Introduction

In a powerful show of global financial impact, Indians working overseas remitted an all-time high of $135.46 billion in FY25, a sharp 14% rise from the previous year. This surge in NRI remittances reflects not just monetary transactions but the emotional and economic bonds that connect India’s vast diaspora to their homeland.

According to data from the Reserve Bank of India (RBI) and the World Bank, India has once again emerged as the world’s top remittance-receiving country, outpacing nations like Mexico, China, and the Philippines. These funds have significantly strengthened India’s foreign exchange reserves, supporting the rupee, funding imports, and boosting overall economic resilience.

Behind this financial wave are real stories—migrant workers in the Gulf sending money to educate their children, tech professionals in the U.S. helping parents back home, and nurses in Europe supporting their families. These remittances fuel rural development, reduce poverty, and power small businesses across the nation.

This achievement isn't just about dollars—it's about trust, love, and duty. It shows how India’s global citizens continue to shape the country's economic future, proving that even from afar, they remain deeply rooted in India’s progress.

2. What are Remittances and Why Do They Matter?

Remittances are the funds that migrants send back home to support their families—often hard-earned savings sent with love, hope, and responsibility. Classified as “private transfers” by the Reserve Bank of India (RBI), these inflows are crucial because they are non-debt creating, meaning the country gains valuable foreign exchange without taking on loans or liabilities.

For millions of Indian households, especially in rural and semi-urban areas, remittances serve as a lifeline of direct income. They help put food on the table, pay school fees, cover medical expenses, and even build homes. In many regions, these funds are the difference between poverty and progress.

On a national scale, India’s remittance inflows are game-changers. They reduce poverty, fuel domestic consumption, and promote investment in health, education, and housing. Most importantly, they ease pressure on the current account deficit and stabilize the rupee by contributing to the foreign exchange reserves.

In essence, remittances are not just monetary transactions—they are silent engines powering India’s growth story. Each dollar sent home by an Indian abroad is a vote of confidence in their roots, a building block in the nation’s economic resilience, and a force of inclusive development.

3. FY25: A Record-Breaking Year for India

FY25 marked a historic milestone for India, with remittance inflows reaching a record $135.46 billion, as per RBI data. This represents a solid 14% growth over the previous fiscal year, underlining the growing economic contributions of Indians living abroad. Here’s how the numbers stack up:

| Year | Remittances (USD Billion) | % Growth |

|---|---|---|

| FY23 | 111.2 | — |

| FY24 | 129.4 | +16.3% |

| FY25 | 135.46 | +14.0% |

What’s fueling this surge?

Several key factors have powered this remittance boom:

- Improved global job markets, especially in healthcare, IT, and construction.

- Higher earnings in developed nations where many Indian professionals and workers are employed.

- The weaker rupee, making each dollar sent home more valuable.

- Rapid expansion of digital remittance platforms, making transfers faster, cheaper, and safer.

This unprecedented rise is more than a financial record—it’s a story of resilience, global integration, and heartfelt commitment by Non-Resident Indians (NRIs). FY25 isn’t just a number—it’s proof that as India’s diaspora grows stronger abroad, its impact back home grows deeper. These remittances continue to uplift families, strengthen rural economies, and stabilize India's fiscal position.

4. India’s Global Standing in Remittance Inflows

India has proudly retained its position as the world’s top recipient of remittances in both 2024 and 2025, reaffirming the strength and size of its global diaspora. According to the World Bank Migration and Remittances Factbook 2025, India received a staggering $135.46 billion in remittance inflows—more than double that of Mexico, the second-largest recipient.

🌍 Global Remittance Comparison (2024):

- 🇮🇳 India: $135.46 billion

- 🇲🇽 Mexico: $68 billion

- 🇨🇳 China: $48 billion

- 🇵🇭 Philippines: $40 billion

- 🇵🇰 Pakistan: $33 billion

India now accounts for over 12% of total global remittance flows, a clear indicator of its deep-rooted international connections. These inflows come from millions of Indians working across the Gulf, North America, Europe, Southeast Asia, and beyond—playing vital roles in healthcare, IT, education, construction, and services.

This leadership in remittances is more than a statistic—it reflects the trust, loyalty, and commitment of the Indian diaspora, who continue to support their families and communities back home. In doing so, they not only elevate household incomes but also reinforce India’s economic position on the global stage.

5. Where Are These Remittances Coming From?

India’s massive remittance inflows are powered by its diverse and widespread global diaspora, with millions of Indians working and thriving across continents. While the Indian presence spans over 100 countries, five key regions dominate remittance contributions, shaping the backbone of this financial flow.

🌍 Regional Breakdown of India’s Remittance Inflows:

| Region | % Share of Remittances |

|---|---|

| Gulf Cooperation Council (GCC) – UAE, Saudi Arabia, Qatar | ~50% |

| North America – USA, Canada | ~20% |

| Europe – UK, Germany | ~10% |

| East Asia – Singapore, Malaysia | ~7% |

| Oceania – Australia, New Zealand | ~5% |

The GCC region leads with nearly 50% of total remittances, thanks to the large population of Indian workers in sectors like construction, hospitality, and healthcare. Meanwhile, North America contributes around 20%, driven by high-skilled professionals in tech, finance, and academia.

This geographic spread showcases the global strength of India’s workforce—from blue-collar laborers to white-collar professionals. These remittances are not just money transfers; they represent sacrifice, ambition, and connection. Each rupee received helps fuel education, build homes, and uplift communities—making India’s global citizens vital contributors to the nation’s economic resilience.

6. Who Sends the Money: The Indian Diaspora

Behind India’s record-breaking remittance numbers is a growing and deeply connected overseas community. The Indian diaspora has nearly tripled since 1990, growing from 6.6 million to over 18.5 million in 2024. This makes India one of the largest contributors to the global migrant population, accounting for about 6% of the total global migrant stock.

But remittances aren’t just financial transactions—they’re acts of care, responsibility, and long-term vision.

Why do Indians abroad send money home?

- To support their families—covering essentials like food, education, and healthcare

- For savings and investments in Indian banks and businesses

- To purchase real estate for retirement or family security

- Through philanthropy—donating to build schools, temples, and hospitals in their hometowns

Workers in the Gulf countries primarily send money to sustain their households, while professionals in the US, UK, and Canada remit for investment, wealth creation, and future financial goals.

This incredible flow of funds from abroad reflects more than economic strength—it reflects emotional bonds, cultural roots, and a powerful desire to give back. The Indian diaspora continues to play a crucial role in shaping India’s growth story, one remittance at a time.

7. How Do Remittances Impact India’s Economy?

Remittances are more than just money—they are a financial lifeline that strengthens both India's macroeconomic stability and the well-being of individual households. With remittance inflows crossing $135 billion in FY25, their impact on India’s economy is both wide and deep.

🔍 Macroeconomic Impact:

- They significantly boost foreign exchange reserves, which stood at $655 billion as of June 2025, enhancing India's financial resilience.

- Help maintain a manageable Current Account Deficit (CAD) by offsetting trade imbalances.

- Fuel rural consumption, encouraging demand for goods and services and driving economic activity in less developed areas.

- Promote financial inclusion, bringing more families into the formal banking system.

🏡 Microeconomic Impact:

- Studies show women are more likely to manage and allocate remittance-based income, leading to better family welfare outcomes.

- Enable families to invest in education, breaking poverty cycles for future generations.

- Improve housing, nutrition, and access to healthcare, especially in remote regions.

In short, every dollar sent home by an Indian abroad reverberates through the economy. It uplifts lives, empowers families, and helps India grow from the grassroots to the global stage—quietly but powerfully shaping the nation's future.

8. Gulf Countries and the Indian Workforce

The Gulf Cooperation Council (GCC) nations are home to over 9 million Indian workers, forming the largest overseas community from India. These workers contribute nearly 50% of India’s total remittance inflows, making the GCC region a critical pillar of India’s economic and social fabric.

🌍 Top GCC Host Countries:

- 🇸🇦 Saudi Arabia

- 🇦🇪 United Arab Emirates (UAE)

- 🇴🇲 Oman

- 🇶🇦 Qatar

- 🇰🇼 Kuwait

- 🇧🇭 Bahrain

Most Indian migrants in the Gulf are engaged in labor-intensive sectors like construction, oil and gas, transportation, and domestic services. Despite modest incomes, they send a large portion of their earnings home every month—often through both formal and informal remittance channels.

For many rural Indian families, these remittances are not just financial support; they’re the backbone of household survival and progress. They help fund children’s education, buy medicines for the elderly, and support farming or small businesses back home.

These Gulf-based workers, often unsung heroes, make enormous sacrifices—working in tough climates and far from family—to ensure better lives for their loved ones. Their contribution is a cornerstone of both India’s rural economy and its foreign exchange strength.

9. Policy Environment: U.S. Tax Relief & Other Developments

In a major policy shift in 2025, the U.S. government revised the “One Big Beautiful Bill Act”, originally proposed by former President Donald Trump, reducing the proposed 5% tax on remittances to just 1%. This move brought significant relief to Indian professionals in the U.S., especially those in the IT sector, and to Non-Resident Indians (NRIs) sending money back home regularly.

Remittance service providers like Western Union, PayPal, Wise, and others also welcomed the change, citing lower costs and increased transaction volumes. For Indian families, it means more money reaching home without excessive deductions—boosting savings, investments, and rural development.

🇮🇳 India’s Proactive Response:

- Signed MoUs with UAE and Saudi Arabia to enhance migrant worker welfare and protections.

- Promoted NPCI’s UPI system for NRIs, especially in the UAE, Singapore, and Oman—making digital remittances seamless and affordable.

- Partnered with banks to incentivize formal remittance channels, ensuring safer, faster transfers.

These policy developments are not just administrative shifts—they are people-centered decisions that make cross-border financial ties stronger, more efficient, and more empowering for India’s global citizens and their families back home.

10. Challenges in Remittance Ecosystem

While India leads the world in remittance inflows, the journey of sending money home is not without its challenges. For millions of NRIs and migrant workers, the process remains costly, risky, and at times, exploitative.

❌ High Transaction Fees

Sending money is still expensive. On average, it costs 6.2% to send $200, far from the UN Sustainable Development Goal (SDG 10.c) target of 3%. These fees eat into the hard-earned money of migrant workers, especially those with modest incomes.

❌ Informal Transfer Channels

In many rural parts of India, hawala and unregulated systems are still in use due to lack of access or awareness about formal channels. These methods are untraceable, risky, and outside the purview of financial regulation.

❌ Exchange Rate Losses

Fluctuations in the Indian rupee can reduce the final amount received by families, adding uncertainty and lowering the value of each remittance.

❌ Labor Rights Issues

Many low-skilled Indian workers in the Gulf face poor working conditions, with limited labor protections and little bargaining power.

11. Expert Opinions & Global Trends

Experts agree that India’s remittance boom is more than just a financial story—it’s a human story of aspiration, resilience, and global integration.

Dr. Raghuram Rajan, former Governor of the Reserve Bank of India, aptly said,

“Remittances are not just about money. They are about human capital, ambition, and global engagement.”

His words reflect how remittances embody the hopes of millions of Indians who have built lives abroad while staying rooted to home.

According to World Bank economist Dilip Ratha,

“India’s remittance boom is sustainable as long as it continues exporting high-skilled and semi-skilled manpower globally.”

This highlights the importance of maintaining India’s competitive edge in education, healthcare, and labor mobility.

🔮 Emerging Global Trends:

- Fintech and blockchain-based remittance platforms are making transfers faster, cheaper, and more secure.

- Diaspora bonds and real estate-linked investments are creating new channels for engaging NRIs in India’s growth.

- Bilateral migration agreements are helping improve labor rights, wages, and living standards for migrant workers.

These trends show that India is not just riding the remittance wave—it is shaping the future of global migration and cross-border finance, with its diaspora as the driving force.

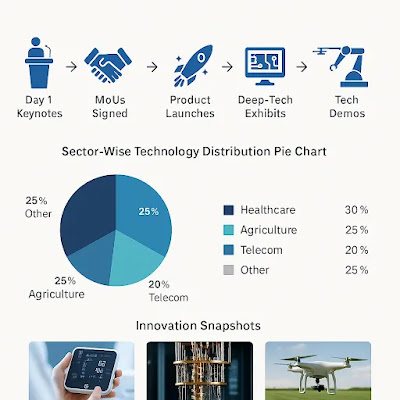

12. Infographics & Visual

- Map of global remittance flows to India

- Bar chart comparing top remittance-receiving countries

- Line graph showing India’s remittance trend (2000–2025)

- Pie chart showing regional sources of Indian remittances

- Infographic on remittance spending (education, healthcare, etc.)

13. Conclusion: Remittance Power in India's Growth Story

India’s remittance story is not just about money—it’s a saga of migration, aspiration, sacrifice, and global ambition. The record-breaking $135 billion received in FY25 is a testament to the power of Indian migrants who bridge borders not just culturally, but economically.

Going forward, India must:

- Leverage fintech to reduce costs

- Protect migrant rights abroad

- Create formal channels and diaspora bonds

- Align remittances with national development goals

The story of Indian remittances is far from over. In fact, it’s evolving—faster and stronger than ever.

14. FAQs

Q1. Why did India receive such high remittances in FY25?

A mix of post-COVID job recovery, weakening rupee, increased overseas earnings, and digital remittance tools.

Q2. Which Indian states receive the most remittance?

Kerala, Uttar Pradesh, Tamil Nadu, Maharashtra, and Punjab are top recipients.

Q3. What are the top countries sending remittances to India?

UAE, USA, Saudi Arabia, UK, and Qatar.

Q4. Are remittances taxable in India?

No, remittances from NRIs to family members are not taxed in India under current income tax laws.

Q5. How can remittance costs be reduced?

Adoption of low-cost digital platforms (e.g., UPI, blockchain), government incentives, and better financial literacy.

.PNG)