GST on Cigarettes, Pan Masala & Gutkha: Rates, Impact & Tax Analysis (2024)

Table of Contents

- Introduction

- Historical Background of Tobacco Taxation in India

- GST Rates on Cigarettes, Pan Masala, and Gutkha

- Impact of GST on the Tobacco Industry

- Duties and Cesses on Tobacco Products

- Pros and Cons of GST on Tobacco Products

- Recent Developments and Proposed Tax Changes

- How to Calculate GST on Cigarettes?

- Critical Analysis: Effectiveness of High Taxation

- Way Forward: Policy Recommendations

- FAQs on GST for Tobacco Products

- Conclusion

1. Introduction

Tobacco use remains a major public health crisis in India, with over 275 million users despite its severe health risks. The government imposes high taxes—28% GST plus excise duties and cesses—to curb consumption while boosting revenue. Yet, the tobacco industry thrives, adapting to regulations and maintaining profitability. The question remains: Are these taxes truly effective in reducing tobacco use, or do they merely shift consumer behavior? While higher prices deter some, addiction and social factors keep many hooked. To truly combat tobacco’s impact, taxation must be paired with stronger awareness campaigns, stricter enforcement, and better cessation support.

2. Historical Background of Tobacco Taxation in India

Tobacco taxation in India has undergone significant changes over the years, reflecting both public health concerns and economic interests. Before the introduction of the Goods and Services Tax (GST) in July 2017, tobacco products were subject to a complex taxation system that included multiple levies at both the central and state levels:

- Excise Duty – Imposed by the Central Government, this was the primary tax on tobacco manufacturing.

- Value-Added Tax (VAT) – Varied across states, making tobacco prices inconsistent nationwide.

- Entry Tax & Octroi – Additional taxes levied by some states and local bodies on the movement of tobacco products.

- Other State Levies – Some states imposed additional charges, further complicating the taxation system.

With the implementation of GST, these taxes were consolidated, bringing uniformity. However, since tobacco is classified as a “sin good”, the government continued to impose extra levies:

- Compensation Cess – Aimed at compensating states for revenue loss post-GST.

- National Calamity Contingent Duty (NCCD) – Levied to fund disaster relief and public health programs.

While GST streamlined the system, the heavy taxation on tobacco aligns with India’s efforts to curb consumption and promote public health.

3. GST Rates on Cigarettes, Pan Masala, and Gutkha

The government has raised GST rates on cigarettes, pan masala, and gutkha to curb consumption and boost revenue. While cigarettes now face a higher cess, pan masala and gutkha are taxed based on their retail selling price instead of MRP. This shift aims to prevent tax evasion and ensure fair taxation. For consumers, this means higher prices, discouraging tobacco use for better public health. For businesses, compliance costs may rise, but transparency improves. While the debate over taxation and personal choice continues, the government's stance is clear—higher taxes on harmful products serve both economic and social welfare goals.

4. Impact of GST on the Tobacco Industry

Impact of GST on the Tobacco Industry

The implementation of the Goods and Services Tax (GST) has significantly reshaped the tobacco industry in India, influencing everything from revenue collection to consumer behavior.

-

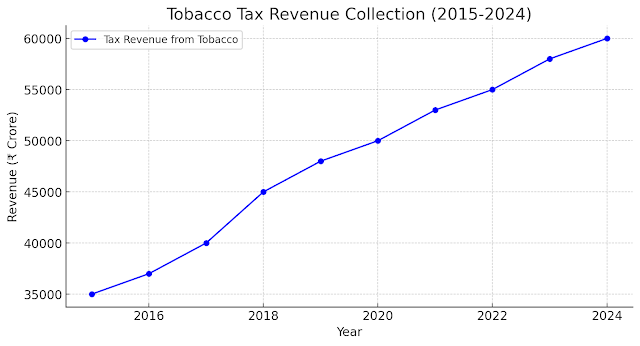

Revenue Generation: Tobacco taxation remains a key contributor to government earnings, generating nearly ₹60,000 crore annually. This revenue is crucial for public health initiatives and infrastructure development.

-

Increase in Selling Price: GST led to a marginal rise in tobacco product prices. However, this increase hasn’t been drastic enough to deter consumption significantly. Addictive nature and brand loyalty keep demand relatively stable.

-

Reduced Profit Margins for Manufacturers: Higher tax rates, including compensation cess, have burdened manufacturers, especially smaller businesses. Compliance costs and reduced affordability have pushed many small-scale producers into financial distress.

Despite these impacts, the industry continues to thrive due to the inelastic demand for tobacco. While GST has ensured better tax compliance, concerns remain about its effectiveness in reducing tobacco consumption and promoting public health.

-

Revenue Collection from Tobacco Taxation (in ₹ crore)

5. Duties and Cesses on Tobacco Products

In addition to GST, the government imposes several other taxes to regulate industries and generate revenue:

- Excise Duty – A flat-rate tax per unit of certain goods, such as alcohol, tobacco, and petroleum products.

- National Calamity Contingent Duty (NCCD) – Levied on specific goods like cigarettes and luxury items to fund disaster relief and recovery.

- Compensation Cess – Introduced post-GST to compensate states for potential revenue losses, primarily applied to luxury and sin goods.

These taxes ensure financial stability, fund essential services, and support economic balance, particularly in times of crisis.

Example of Duty Calculation for a Pack of Cigarettes

6. Pros and Cons of GST on Tobacco Products

✅ Pros

✔ Higher Tax Revenues – Helps fund healthcare and anti-tobacco programs.

✔ Simplification of Taxation – Replaces multiple indirect taxes.

✔ Potential Reduction in Consumption – Higher prices discourage new users.

❌ Cons

❌ Limited Impact on Consumption – Addicted users continue buying despite high prices.

❌ Rise of Illicit Trade – Smuggling and illegal cigarette production increase.

❌ Job Losses in Tobacco Industry – Higher taxation affects small producers.

7. Recent Developments and Proposed Tax Changes

The Changing Landscape of Tobacco Taxation

The Indian government is making significant changes to tobacco taxation, impacting consumers and industries alike. Here’s what you need to know:

-

Budget 2023: NCCD Increase

The National Calamity Contingent Duty (NCCD) on cigarettes was raised by 16%, leading to a noticeable price hike. This move aligns with public health goals, discouraging smoking while increasing revenue. -

55th GST Council Meeting: A Major Tax Hike?

The upcoming GST Council meeting is expected to propose a 35% GST on over 148 items, including tobacco products. If passed, this will further drive up the cost of smoking, making it a luxury rather than a habit. -

Exploring Alternative Revenue Models

With traditional tobacco products facing higher taxes, the government is looking at new revenue sources. E-cigarettes and vaping products could soon be taxed, balancing health concerns with economic interests.

These changes signal a strong regulatory shift, aiming to reduce tobacco consumption while boosting revenue. While smokers may feel the pinch, public health advocates see this as a win. Is this the beginning of a tobacco-free future? Only time will tell.

-

8. How to Calculate GST on Cigarettes?

Calculating GST on cigarettes is simple if you follow these steps:

- Know the GST Rate – In many countries, cigarettes attract a high GST rate (often 28%) plus a compensation cess.

- Find the Base Price – This is the cost of cigarettes before tax.

- Apply GST – Multiply the base price by the GST rate (e.g., 28%).

- Add Compensation Cess – Cigarettes have an additional cess based on length and type.

- Final Price – Add all taxes to the base price.

Always check the latest tax rates to ensure accurate calculations.

9. Critical Analysis: Effectiveness of High Taxation

Taxation is a powerful policy tool, but its effectiveness depends on behavioral and economic factors. Let's analyze whether high taxes achieve their intended goals.

🔹 Do Higher Taxes Reduce Consumption?

- Research suggests that habitual smokers in India exhibit low price elasticity, meaning they continue to buy tobacco despite price hikes.

- However, youth and low-income groups are more price-sensitive. Increased taxes may deter them from initiating or continuing smoking, potentially reducing tobacco use in the long run.

- The challenge? Addiction weakens the impact of taxation, making demand relatively inelastic among long-term users.

🔹 Rise of Illicit Trade

- The unintended consequence of high tobacco taxes is a surge in smuggling and counterfeit products.

- Post-GST, the illegal cigarette market has expanded, allowing foreign brands and fake products to bypass taxation.

- India loses approximately ₹13,000 crore annually due to tax evasion in the tobacco sector.

- This black market poses health risks (due to unregulated ingredients) and undermines public health policies.

While high taxation can discourage new users, it fails to curb consumption among addicts and fuels an illicit market. A balanced approach—combining taxes with anti-smoking campaigns, rehabilitation programs, and strict enforcement against smuggling—may be more effective.

10. Way Forward: Policy Recommendations

Strengthening Tobacco Control: Key Actions

-

Increase Tobacco Taxation – Raising taxes further can deter smoking, reduce health risks, and align with WHO’s 75% tax burden recommendation.

-

Crack Down on Illicit Trade – Stricter enforcement against smuggling prevents tax evasion and ensures regulations are effective.

-

Tax E-Cigarettes & Vaping – Expanding taxation to these products helps curb nicotine addiction, especially among youth.

-

Reinvest Tax Revenue in Public Health – Directing funds toward anti-tobacco campaigns, cessation programs, and healthcare can create a healthier future.

A higher tax isn’t just about revenue—it’s about saving lives.

11. FAQs on GST for Tobacco Products

1. How to Calculate GST on Tobacco Products?

To determine the GST on tobacco products, multiple tax components must be considered:

- Base Price (Cost Price of the Product)

- Excise Duty (if applicable)

- National Calamity Contingent Duty (NCCD)

- GST @ 28%

- Compensation Cess (Varies by product type)

Example Calculation: For a pack of 10 cigarettes (up to 65mm in length), the total tax burden includes GST, cess, and other applicable duties.

2. What is the GST Rate and Compensation Cess on Tobacco Products in India?

The GST rate on all tobacco products is 28%. Additionally, a compensation cess is levied to offset revenue losses under the GST system. The cess rate varies by product type, such as cigarettes, chewing tobacco, and bidis.

3. What is the Higher GST Rate on Tobacco in India?

Currently, the GST rate is 28%, the highest slab. However, with compensation cess, the total tax burden is significantly higher.

- In the 55th GST Council Meeting (expected in 2024), discussions are ongoing to increase GST to 35% on tobacco and cigarettes to discourage consumption.

4. What is the GST Rate on Gold Flake Cigarettes in India?

Gold Flake Cigarettes fall under the 28% GST category. Additionally, a Compensation Cess is applied, which varies based on the cigarette length:

- Up to 65mm: ₹2,076 per 1,000 sticks

- 65-70mm: ₹2,747 per 1,000 sticks

- Above 70mm: Higher cess rates apply

5. What is the Total Tax on Cigarettes in India?

The total tax burden on cigarettes consists of:

- GST @ 28%

- Compensation Cess (Fixed per 1,000 sticks)

- National Calamity Contingent Duty (NCCD)

- Excise Duty (if applicable)

Due to these multiple layers of taxation, the effective tax on cigarettes can exceed 60% of the selling price.

6. What is the Excise Duty on Tobacco After GST Implementation?

Even after GST implementation, excise duty still applies to tobacco products since they are classified as "sin goods."

- Excise duty is calculated on the "abated value" (adjusted for tax deductions), while GST is applied on the final transaction value.

- No tax reduction or abatement is permitted for tobacco products under GST law.

These high tax rates aim to discourage tobacco consumption and generate revenue for public health initiatives.

🔹 Have More Questions? Let us know in the comments!

📌 Stay Updated: The 55th GST Council Meeting is expected to discuss further tax hikes on tobacco and cigarettes. Stay tuned for updates!

12. Conclusion

Higher GST on cigarettes and tobacco products has boosted government revenue but hasn’t significantly reduced consumption. While prices have risen, addiction keeps demand steady. Many users continue buying despite the cost, highlighting the limitations of taxation alone. To truly curb tobacco use, stricter regulations, better enforcement, and even higher taxes—aligned with global best practices—are needed. Public awareness campaigns and accessible cessation programs must also play a role. Without a comprehensive approach, higher taxes may only burden consumers without achieving the larger goal of reducing tobacco-related harm. The fight against tobacco requires stronger, multi-faceted efforts beyond just taxation.

.PNG)